unemployment tax refund 2021 update

The rate of the following years is quite different and lean on many elements. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year.

Irs Sends First Unemployment Tax Refunds But Automatic State Refunds Are In Limbo Mlive Com

A quick update on irs unemployment tax refunds today.

. 2 This Notice is an update to the Notice published April 1 2021 and provides guidance to. Thats the same data. From 2021 the FUTA tax rate is 60 and it applies to the first 7000 in annual wages paid per employee.

The agency had sent more than 117 million refunds worth 144 billion as of Nov. During the month November the IRS might surprise you with a deposit or an extra refund check for your 2020 taxes. This Notice addresses the unemployment compensation exclusion also unemployment exclusion in the federal American Rescue Plan Act 1 and its effect on the taxable income of Michigan resident taxpayers under the Michigan Income Tax Act.

1222 PM on Nov 12 2021 CST. TAS Tax Tip. Therefore personal income taxpayers do not need to report these amounts.

This video is about the 2021 IRS unemployment tax refund. 102 excludes PPP loan forgiveness from Massachusetts gross income for 2021 for taxpayers subject to the Massachusetts personal income tax. Your tax rate FUTA varies between 00 and 54 due to various factors including your federal tax responsibility.

The update says that to date the IRS has issued more than 117 million of these special refunds totaling 144 billion. I mailed my 2021 tax return April 22 2021 and it was received April 24 2022. WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns.

The IRS plans to send another tranche by the end of the year. IR-2021-159 July 28 2021. You dont have to do anything obviously and they will eventually direct deposit what you are supposed to receive.

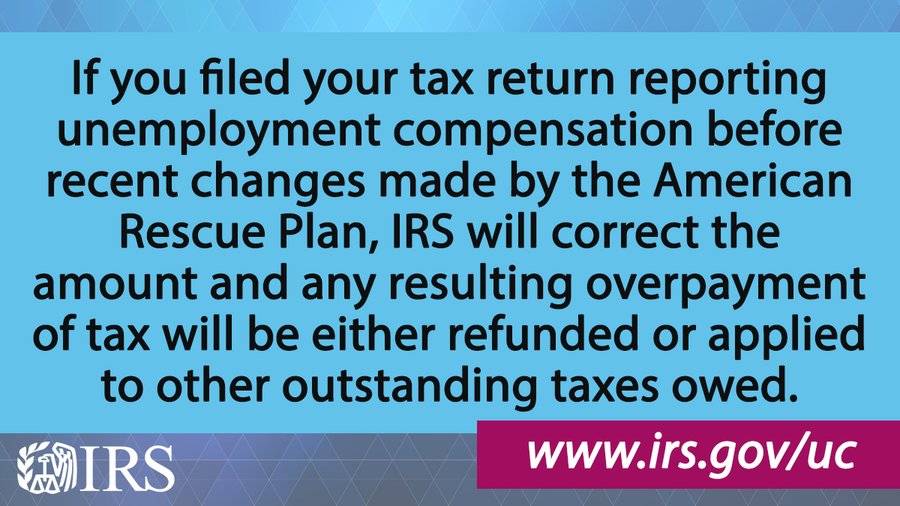

The American Rescue Plan Act of 2021 offered relief to people who received unemployment compensation in 2020 at the height of the pandemic when companies were laying off millions of workers. This Notice addresses the unemployment compensation exclusion also unemployment exclusion in the federal American Rescue Plan Act 1 and its effect on the taxable income of Michigan resident taxpayers under the Michigan Income Tax Act. The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in.

Do we need to file an amended return or pay back all or some of the refund we received. If you overpaid taxes on your 2020 unemployment benefits refunds averaging 1265 will begin hitting direct deposit accounts Wednesdayone day. Thousands of taxpayers may still be waiting for a.

Tried the track my refund on IRS site and it doesnt show anything related to the new amount so doubt they will take the time to update the site. 2 This Notice is an update to the Notice published April 1 2021 and provides guidance to. The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020.

The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. More 2021 unemployment compensation exclusion adjustments and refunds in some cases coming. I have heard nothing and I get.

Since May the IRS has been making adjustments on 2020 tax returns and issuing refunds averaging around 1600 to those who can claim an unemployment tax break. Another 15 million taxpayers will receive their unemployment tax refunds as the IRS continues to adjust returns based on a provision of the. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in 2020.

Congress hasnt passed a law offering. It excludes up to 10200 of unemployment compensation payments from gross income if the taxpayers modified adjusted gross income is less than 150000. The first 10200 of 2020 jobless benefits 20400 for married couples filing jointly was made nontaxable income by the American.

That could leave some taxpayers saddled with reportable income on 2021 federal and state taxes that they may later have to return to the state. Added January 7 2022 A10. The american rescue plan act which was signed on march 11 included a 10200 tax exemption for 2020 unemployment benefits.

The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time. In the latest batch of refunds announced in November however the average was 1189. The IRS reported that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust taxable income amounts based on the exclusion for unemployment compensation from previously filed income tax returns.

Recently passed Massachusetts legislation An Act Relative to Immediate COVID-19 Recovery Needs St. We received a notice stating the IRS corrected our return to allow the unemployment compensation exclusion but we believe the exclusion amount is too much. On May 14 the Internal Revenue Service announced they will be correcting and sending out the unemp.

My refund should have been sent to my bank account around the middle to the end of June. Unemployment Tax Refunds Update and Recap A little background in case you didnt know due to the recent passage of the American Rescue Plan of 2021the IRS has now considered the first 10200 of unemployment compensation received in 2020 as non-taxable. This tax break was applicable.

The IRS moved quickly to implement the provisions of the American Recovery. According to senior fellow and. Last year the government imposed no taxes on those who received up to 10200 of benefits in 2020 as part of the COVID-19 relief law the American Rescue Plan Act.

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

2021 Unemployment Benefits Taxable On Federal Returns Cbs8 Com

Unemployment Compensation Are Unemployment Benefits Taxable Marca

Waiting For Your Unemployment Tax Refund About 436 000 Returns Are Stuck In The Irs System

When Will Irs Send Unemployment Tax Refunds In June How Many People Are Receiving Them As Usa

Unemployment Tax Break Surprise 581 Checks Paid Out To 524 000 Americans In Time For New Year S Eve Marca

Unemployement Benefits Will I Get A Tax Refund For This Benefit Marca

Irs Sending Out 4 Million Surprise Tax Refunds This Week Wpri Com

State Income Tax Returns And Unemployment Compensation

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

Unemployment Tax Refund Update What Is Irs Treas 310 11alive Com

2021 Unemployment Benefits Taxable On Federal Returns Cbs8 Com

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs Unemployment Refund Update How To Track And Check Its State As Usa

Irs Tax Refund Delays Persist For Months For Some Americans Abc7 Chicago

Unemployment Tax Refund Update What Is Irs Treas 310 Weareiowa Com